Credit union

Whether it's helping you with referrals or getting you up to speed on the latest annuity options for members' needs, we've got you covered.

Looking to increase referrals?

We can help.

We're here to help cultivate relationships within your credit union branch, build member retention and help members pursue the financial futures they deserve.

Guaranteed income can be essential for a healthy retirement

Having a steady stream of income in retirement can be critical. We have many options to pursue guaranteed* income for life,† no matter how long you live or what happens in the market.

Track investment performance with real-life data

Experience firsthand the combined power of Jackson performance and Morningstar® analytics to help you stay on top of your members' investing goals.

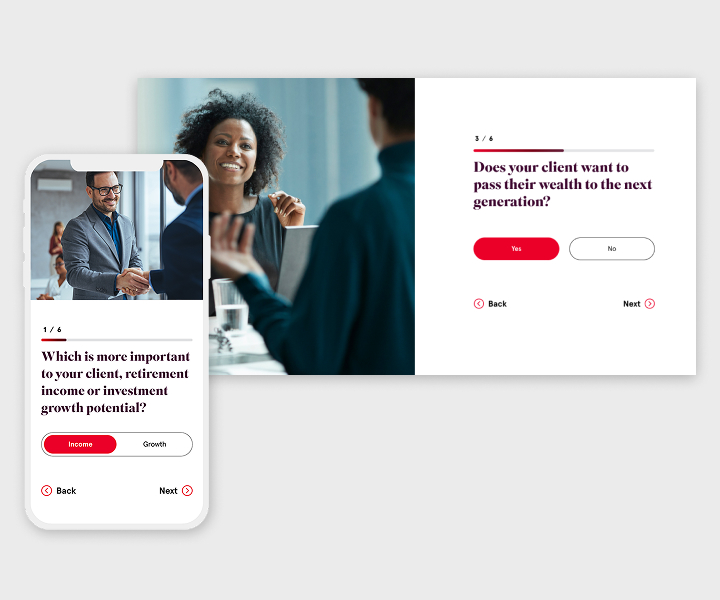

Match members’ goals with products that could help get them there

Use Product Match Pro, our quick and easy matching tool, to help address members’ aspirations.

- Start a conversation with members about their needs

- Identify annuity options that align with those needs

- Show members the importance of retirement planning

Annuity options for nearly every member need

Every retirement is unique. It's why we offer many types of annuities designed to fit your members' goals.

Spread-based products

Fixed and fixed-index annuities are designed to offer reward with little risk.

Annuities are long-term, tax-deferred vehicles designed for retirement. Variable annuities and registered index-linked annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met. Add-on benefits are available for an extra charge in addition to the ongoing fees and expenses of the annuity and may be subject to conditions and limitations.

Model members' portfolios with our award-winning1 RILA tool

Find your wholesaler

If you already do business with us, quickly locate your Jackson representative.

Not appointed?

If you need new business opportunities but aren't set up yet, we're here to help.

*Guarantees are backed by the claims-paying ability of Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York.

†Lifetime income of the add-on benefit becomes effective at issue if the designated life is age 59½ at issue, or upon the contract anniversary following designated life's 59½ birthday, provided the contract value is greater than zero and has not been annuitized.

‡Add-on benefits that provide income for the length of a designated life and/or lives may be available for an additional charge. The amount of income that these benefits may provide can vary depending on the age when income is taken, and how many lives are covered when the benefit is elected. The cost of these benefits may negatively impact the contract's cash value. There is no guarantee that an annuity with an add-on living benefit will provide sufficient supplemental retirement income.

§Diversification does not assure a profit or protect against loss in a declining market.

**Tax deferral offers no additional value if an IRA or qualified plan, such as a 401(k), is used to fund an annuity and may be found at a lower cost in other investment products. It also may not be available if the annuity is owned by a legal entity such as a corporation or certain types of trusts.

1Datos Insights 2024 Insurance Technology Impact award and 10th annual 2024 WealthManagement.com Industry Awards “Wealthies” award in the insurance category for Jackson’s registered index-linked annuity (RILA) digital ecosystem.

Before investing, investors should carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options. The current contract prospectus and underlying fund prospectuses provide this and other important information. Please contact your Jackson representative to obtain the prospectuses. Please read the prospectuses carefully before investing or sending money.

Jackson, its distributors, and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Tax laws are complicated and subject to change. Tax results may depend on each taxpayer’s individual set of facts and circumstances. Clients should rely on their own independent advisors as to any tax, accounting, or legal statements made herein.

Guarantees are backed by the claims-paying ability of Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York. They are not backed by the broker/dealer from which this annuity contract is purchased, by the insurance agency from which this annuity contract is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York.

The latest maturity date or income date allowed under an annuity contract is age 95, which is the required age to annuitize or take a lump sum. Please see the prospectus for important information regarding the annuitization of a variable annuity contract.

Morningstar® and the Morningstar logo are registered trademarks of Morningstar, Inc. All other Morningstar products and proprietary tools, including Morningstar Ratings and Morningstar Style Box are trademarks of Morningstar, Inc.

Annuities are issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and in New York by Jackson National Life Insurance Company of New York (Home Office: Purchase, New York). Variable annuities and registered index-linked annuities are distributed by Jackson National Life Distributors LLC, member FINRA. These products have limitations and restrictions. Discuss them with your clients or contact Jackson for more information.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company®, and Jackson National Life Insurance Company of New York®.

Products and features may be limited by state availability, and/or your selling firm's policies and regulatory requirements (including standard of conduct rules).