Serving your business

at your speed

Financial professionals like you have relied on us to support their client needs for more than 60 years. Join the 120,000 financial professionals who work with us for the knowledge, discipline and service we offer.

Choose your financial firm type so we can get started

Products as diverse as your clients

We offer a wide range of ways to explore our products, so you can really get to the heart of your clients' financial goals.

- Deep dive into our flexible, tax-deferred* annuity suites

- Match goals with annuities on our Product Match Pro tool

- Investigate client needs if your clients are unsure of what they really need in retirement

Annuities are long-term, tax-deferred vehicles designed for retirement. Variable annuities and registered index-linked annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met.

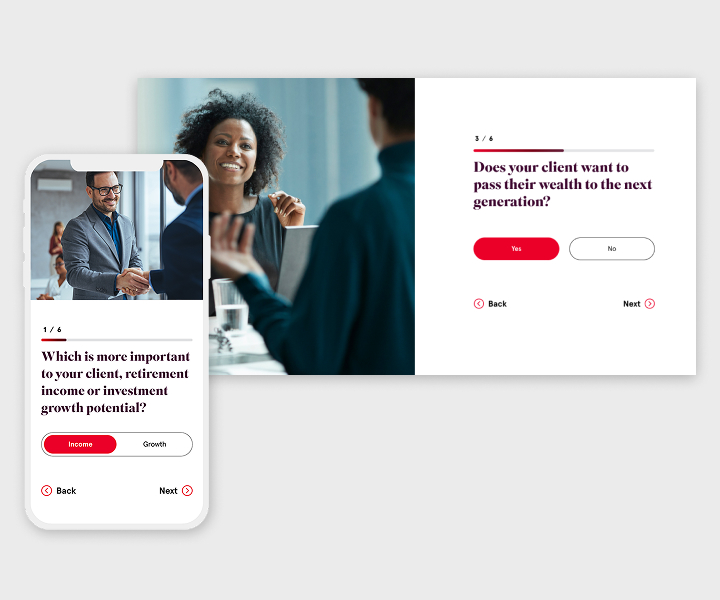

Match clients' goals with products that could help get them there

Use Product Match Pro, our quick and easy matching tool, to help address clients' aspirations.

- Start a conversation with clients about their needs

- Identify annuity options that align with those needs

- Show clients the importance of planning for retirement

Boost your business with our tools and resources

We're here with the latest info and tools so you can stay up to date. Keep your business running at full speed with:

- Tax and income calculators

- Variable annuity performance centers

- Live webinars, articles and insights from thought leaders

Why Jackson?

Because we can help.

Because we can help.

Over the past 60 years, we've learned what financial professionals need to empower their businesses. With many dedicated teams to serve, we'd like to start working with you today.

- Wholesaler support teams

- Advanced planning for trusts and taxes

- Platform and advisory integration

- Portfolio strategy and suitability needs

- Award-winning call center1

*Tax deferral offers no additional value if an IRA or qualified plan, such as a 401(k), is used to fund an annuity and may be found at a lower cost in other investment products. It also may not be available if the annuity is owned by a legal entity such as a corporation or certain types of trusts.

1SQM (Service Quality Measurement Group) Call Center Awards Program for 2004 and 2006–2024. (Criteria used for Call Center World Class FCR Certification is 80% or higher of customers getting their contact resolved on the first call to the call center (FCR) for 3 consecutive months or more.)

Jackson, its distributors, and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Tax laws are complicated and subject to change. Tax results may depend on each taxpayer’s individual set of facts and circumstances. Clients should rely on their own independent advisors as to any tax, accounting, or legal statements made herein.

Annuities are issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and in New York by Jackson National Life Insurance Company of New York (Home Office: Purchase, New York). Variable annuities and registered index-linked annuities are distributed by Jackson National Life Distributors LLC, member FINRA. These products have limitations and restrictions. Discuss them with your clients or contact Jackson for more information.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company®, and Jackson National Life Insurance Company of New York®.

Products and features may be limited by state availability, and/or your selling firm's policies and regulatory requirements (including standard of conduct rules).