Registered index-linked annuities

Help your clients prioritize growth opportunities while also helping them manage the amount of loss they’re comfortable with. That’s flexibility.

Flexibility is letting clients have options

Our registered index-linked annuities (RILAs) allow clients to choose from multiple indexes, protection levels and even income options to pursue the retirement they want.

- Pursue growth

- Elect protection options

- Guaranteed* lifetime income† may be available, at an extra cost‡

A RILA is a long-term tax-deferred vehicle designed for retirement. It is subject to investment risk, the value will fluctuate, and loss of principal is possible. A RILA, which is an insurance contract, allows you to choose how you want to prioritize growth opportunities while managing the amount of loss you may assume. Earnings are taxable as ordinary income when distributed, Individuals may be subject to a 10% additional tax for withdrawals before the age of 59½ unless an exception to the tax is met. Add-on benefits may be available for an additional charge and may be subject to conditions and limitations.

Clients have these needs? A RILA may help.

Jackson Market Link Pro® Suite

Designed to help customize clients’ growth options while also offering levels of protection for

their assets.

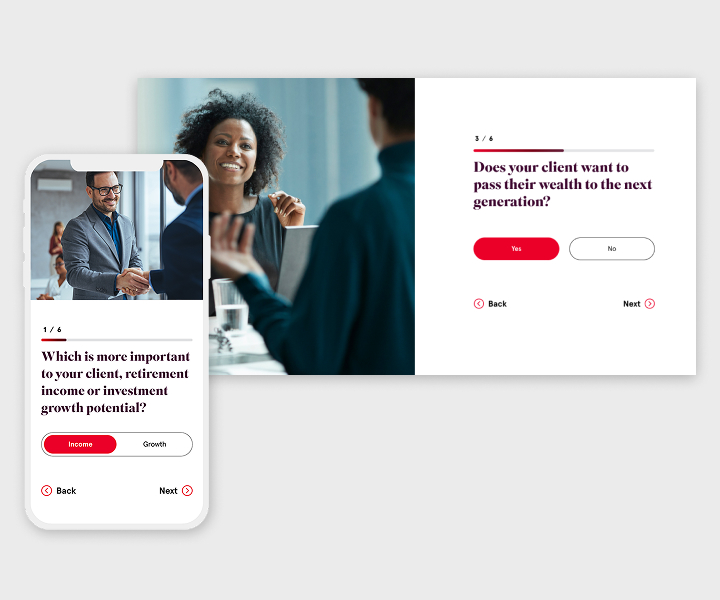

Match clients’ goals with products that could help get them there

Use Product Match Pro, our quick and easy matching tool, to help address clients' aspirations.

- Start a conversation with your clients about their needs

- Identify annuity options that align with those needs

- Show clients the importance of planning for retirement

To see other options, check out these annuities

We understand that a certain annuity doesn’t always work for certain plans. It’s why we offer many types to fit the unique needs of your clients.

*Guarantees are backed by the claims-paying ability of Jackson National Life Insurance Company.

†Lifetime income of the add-on benefit becomes effective at issue if the designated life is age 59½ at issue, or upon the contract anniversary following designated life's 59½ birthday, provided the contract value is greater than zero and has not been annuitized.

‡Add-on benefits that provide income for the length of a designated life and/or lives may be available for an additional charge. The amount of income that these benefits may provide can vary depending on the age when income is taken, and how many lives are covered when the benefit is elected. The cost of these benefits may negatively impact the contract's cash value. There is no guarantee that an annuity with an add-on living benefit will provide sufficient supplemental retirement income.

§Diversification does not assure a profit or protect against loss in a declining market.

**Select up to 99 investments and adjust options or allocations up to 25 times each contract year without transfer fees. To prevent abusive trading practices, Jackson restricts the frequency of transfers among variable investment options including trading out of and back into the same subaccount with a 15-day period.

This material is authorized for use only when preceded or accompanied by the current contract prospectus. Before investing, investors should carefully consider the investment objectives and risks of the registered index-linked annuity. This and other important information is contained in the current contract prospectus Jackson.com/ProspectusJMLP3 for the Jackson Market Link Pro III prospectus or Jackson.com/ProspectusJMLPA3 for the Jackson Market Link Pro Advisory III prospectus. Please read the prospectus carefully before investing or sending money.

Jackson, its distributors, and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Tax laws are complicated and subject to change. Tax results may depend on each taxpayer’s individual set of facts and circumstances. Clients should rely on their own independent advisors as to any tax, accounting, or legal statements made herein.

Impact of withdrawals:

Withdrawals may be subject to withdrawal charges or market value adjustments (MVA) and the interim value adjustment may apply.

Withdrawals before the end of a term are subject to an interim value adjustment. The interim value adjustment may have a positive or negative impact on the contract value at the end of the term which may be significant.

For Jackson Market Link Pro III, withdrawal charges will apply to withdrawals during the first six years of the contract which will result in reduced contract value. The withdrawal charge schedule is 8%, 8%, 7%, 6%, 5%, 4%, 0%.

For Jackson Market Link Pro Advisory III, a market value adjustment (MVA) will be applied to certain amounts withdrawn or annuitized during the first six contract years. The MVA may results in an increase or decrease to amounts removed from the contract.

Guarantees are backed by the claims-paying ability of Jackson National Life Insurance Company. They are not backed by the broker/dealer from which this annuity contract is purchased, by the insurance agency from which this annuity contract is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of Jackson National Life Insurance Company.

Owners could see a substantial loss during an index period if the index declines more than the level of downside protection. If an owner does see a substantial loss during an index period, the owner may not be able to participate fully in a subsequent market recovery due to the capped upside potential in subsequent index periods. Indexes are unmanaged and unavailable for direct investment. The payment of dividends is not reflected in the index return.

The latest maturity date or income date allowed under an annuity contract is age 95, which is the required age to annuitize or take a lump sum.

Fixed index annuities are also referred to as fixed annuities with index-linked interest in the contract.

Annuities are long-term, tax-deferred vehicles designed for retirement and are insurance contracts. Variable annuities and registered index-linked annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met. Add-on benefits are available for an extra charge in addition to the ongoing fees and expenses of the annuity and may be subject to conditions and limitations. There is no guarantee that an annuity with an add-on living benefit will provide sufficient supplemental retirement income.

Jackson Market Link Pro III and Jackson Market Link Pro Advisory III are not available in New York.

Registered index-linked annuities (contract form numbers ICC24 RILA300, ICC24 RILA300-CB1, ICC24 RILA302, ICC24 RILA302-CB1, ICC24 RILA305, ICC24 RILA305-FB1, ICC24 RILA307, ICC24 RILA307-FB1) are issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and distributed by Jackson National Life Distributors LLC, member FINRA. May not be available in all states and state variations may apply. These products have limitations and restrictions, including withdrawal charges or market value adjustments. Jackson issues other annuities with similar features, benefits, limitations, and charges. Discuss them with your clients or contact Jackson for more information.

Jackson® is the marketing name for Jackson Financial Inc. and Jackson National Life Insurance Company.®

Products and features may be limited by state availability, and/or your selling firm's policies and regulatory requirements (including standard of conduct rules).